GILLETTE - Fond memories come to the surface when Terry and Janet Tharp think back to moments they experienced as children at what's now called the Medicine Lodge Archaeological Site. Growing up in the late 1950s and 1960s near Hyattville, the now married couple said the site wasn't called that yet. It was simply a ranch - an area where Janet was taken for picnics on a school field trip and the home of children Terry went to school with. "The kids that lived there on that ranch, they would go...

Voters will be asked this year to again approve the Specific Purpose Sales and Use Tax (SPOT), which raises money that goes directly to the four municipalities and the county and is used for infrastructure needs that are often difficult to fund elsewhere. This time, at the suggestion of Pine Haven Mayor Karla Brandenburg, the amount to be raised for each entity may be increased from $1.5 million to $3 million. This doesn’t change the amount of the tax itself – it’s still just a penny, she said, and it’s a penny that is already in...

As the county moves to update its land use plan, the commission must make certain decisions about the process and its outcome. Key to these decisions will be the involvement of the public, and also the municipalities – especially, said Community Planning and Zoning Consultant Jayna Watson, if the commission still wants to encourage development towards the county’s population centers. A refresh of the comprehensive land use plan is a potential first step towards zoning, which the county has been considering as a way to provide more control...

A scuffle over road maintenance on a quarter-mile stretch of Old Sundance Rd may have reached its conclusion for now, it seems, after the county commissioners said they would not add it to the agenda again for at least another year. The commission’s answer has not changed since Eric Akola first attended a meeting to request that this portion of road be plowed in the winter. “We are going to maintain the county roads that we maintain now,” stated Commissioner Fred Devish, later adding, “I don’t know how we can make it any plainer...

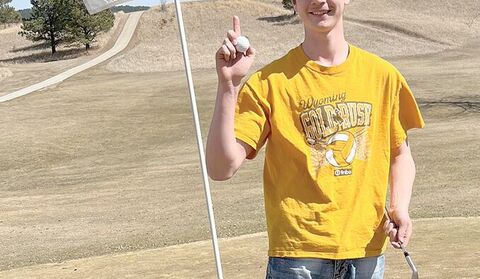

Owen Watt got a hole-in-one at the Sundance Country Club on Thursday, April 4 using a 6 iron on hole #3. This is his first...and the first time Coach Dutton has had a high school golfer get a...

The Sundance track team crossed state lines last week as they competed in the Queen City Classic in Spearfish on Friday. The Queen City Classic is a meet that attracts many schools and the Bulldogs were up against some stiff competition. "These kids are doing an awesome job of working at practice and it's showing at the meets!" head coach Julie Cross stated. Although not all Bulldogs placed in the top eight, many set their own personal or season records throughout the day at the Classic. With...

HS Track Fri., Apr. 12, 9 a.m. at Upton Tues., Apr. 16, 4 p.m. at Wright Fri., Apr. 19, 9 a.m. at Douglas HS Golf Fri., Apr. 12, 8 a.m. at Kendrick Fri., Apr. 19, 8 a.m. at Powder Horn JH Track Fri., Apr. 12, 9 a.m. at Upton Fri., Apr. 19, 9 a.m. at Lead/Deadwood JH Golf Mon., Apr. 15, 8:30 a.m. at...

Breakfast Apr. 15 – Cereal, toast, juice, fruit, milk Apr. 16 – Bagel mini, GoGurt, cereal, fruit, milk Apr. 17 – Cinnamon roll, cheese stick, cereal, fruit, milk Apr. 18 – Breakfast pretzel, yogurt, cereal, fruit, milk Lunch Apr. 15 – Rice bowl, tortilla chips, fruit, vegetable, health bar, milk Apr. 16 – Pulled pork sandwich, chips, fruit, vegetable, health bar, milk Apr. 17 – Chicken nuggets, Italian ice, fruit, vegetable, health bar, milk Apr. 18 – Chicken patty sandwich (original or spicy), potato chips, fruit, vegetable,...

Dear Editor, I returned to Crook County to my grandfather’s place on Rifle Pit Road in 1975. At that time there wasn’t a single light in the night sky visible from my home. I could make out trucks and cars on Interstate 90 during the day, but at night there was almost no traffic. Now, there are clusters of light to my north, east and west and the freeway is a constant stream of vehicles. Surely, I liked it better 49 years ago, but with global population on its way to nine billion, and the worsening effects of the damage eight billion...

Sundance Friends of the Library invites you to their National Library Week Appreciation Luncheon on Thursday, March 11 from 11:30-1 p.m. at the library. This is a FREE THANK YOU event for all who have supported our fundraisers throughout the year. Your generous contributions to our Valentine’s Bake Sale, Summer Camping Basket Raffle, Book Sale and Holiday Basket Raffle fund our support of the library. With your help we have provided the library with a multi-functional utility cart, a four-foot safety step ladder, foyer display bookcase,... Full story